How Hatch enables NZ to invest in the digital era

For many Kiwis, investing has traditionally been something that feels out of reach. It might be thought of as an activity reserved for the wealthy, or at least those with plenty of spare money each month to think about.

Investing can also seem confusing or risky - almost like rolling the dice to win or lose - to those who haven’t started.

Ironically it is getting over those initial hurdles, starting investing and having your money grow as a result over many years which is what typically allows people to become wealthy in the first place.

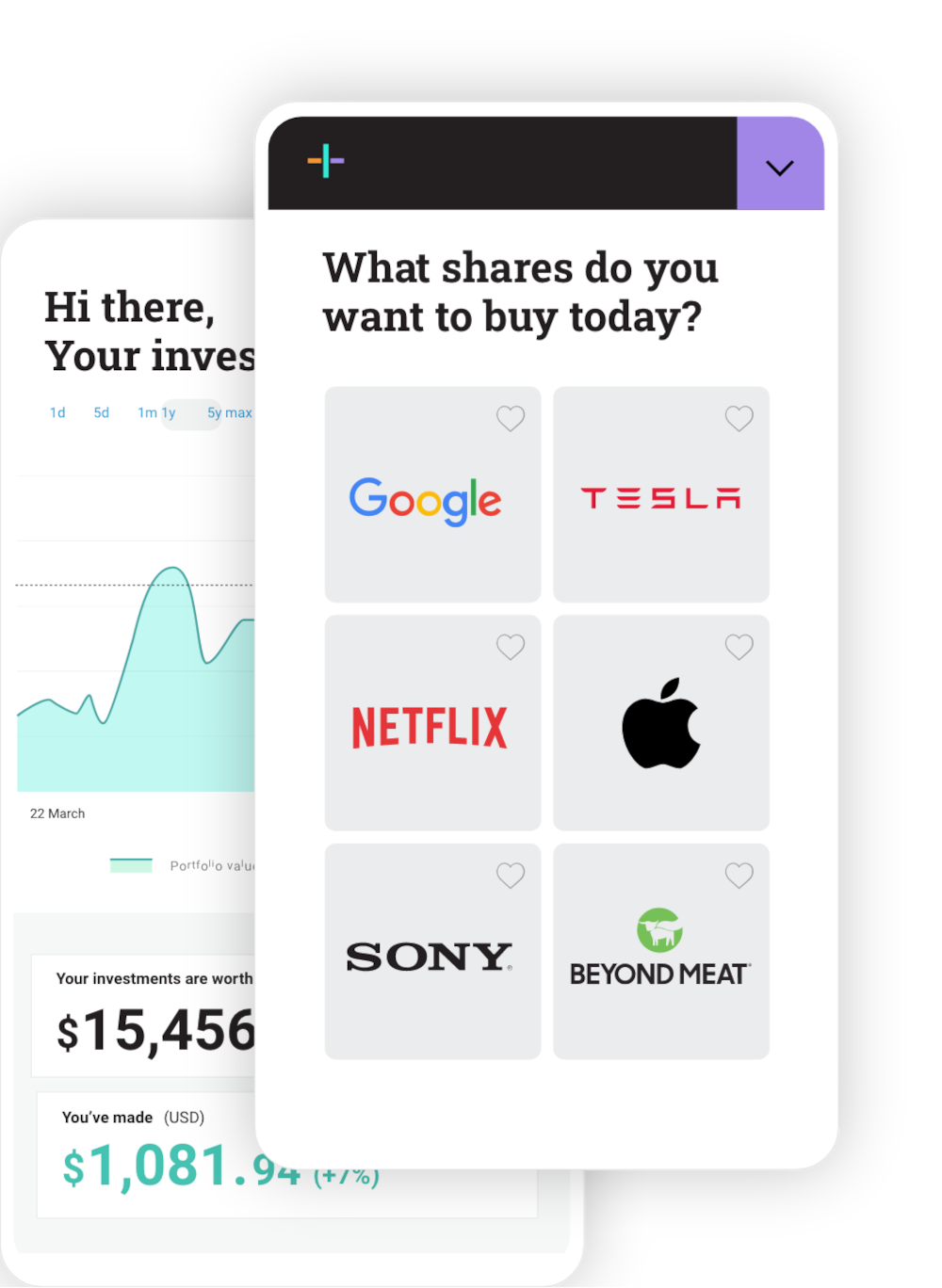

Thankfully over recent years much more user-friendly investing methods have emerged, allowing everyday people to put any sum of money they’re comfortable with into shares of global companies that they love and believe will continue going up in value over the coming years - whether that is Apple, Tesla, Amazon - or any number of other companies or funds.

Today I’m talking with Natalie Ferguson, one of the co-founders of Hatch, one such Kiwi investment platform that is changing the game for any New Zealanders wanting to get involved with investing.

Disclaimer: Obviously none of this is financial advice, you need to do your own research. Everyones situation is different and speaking with a financial advisor can help clarify what your options are.

What is Hatch, and who is it for?

Hatch is an investing platform for Kiwis. Three years ago, we were the first to give New Zealanders affordable access to the US share markets, and that’s just the beginning. Our goal is to help every Hatch customer become a millionaire. Crazy? No, it’s entirely possible when you put in place good money habits.

I understand that you were one of the co-founders of Hatch. How did this come about?

Hatch is a relatively new type of business, one that ‘hatched’ within an existing well-established corporate - Kiwi Wealth. Kiwi Wealth recognised the finance industry was changing, so they brought in a small group of entrepreneurs and gave us a blank slate to look at opportunities to innovate. Three months later, we pitched them the first version of Hatch.

There have been a flurry of retail investment platforms emerging and growing rapidly over the last couple of years, both in New Zealand and around the world – what do you think is driving this, and where do you see that trend going over the coming years?

My favourite topic. When we launched, the only realistic options Kiwis had to put their money to work were property and the NZX. We saw a different New Zealand. One where all of us had access to world class investing opportunities and the chance to own a slice of the companies changing the world. We’re part of a bigger global movement, where technology and finance have combined to make it possible to take the tools and opportunities previously reserved for the financial elite, and put them in the hands of everyday people.

In the past, you had to hand your money to a fund manager and had no control (or visibility) over where it was invested (and you had to pay whopping fees for the privilege). Now you can hand pick companies, industries and trends that you believe in and back them. That’s a game changer.

In the past 3 years, we’ve seen experienced investors change their behaviour - from investing a few lump sums whenever they had enough to justify the fees, to buying shares every pay cycle. But the biggest shift is in those who have never invested before. They’re not just taking money out of savings and term deposits, we think this new generation of investors are sometimes choosing to buy shares in companies, instead of products from them. They learn by doing and because of that, they’re avoiding the mistakes made in the past - like the hyped up get-rich-quick schemes that burned many in the 1980s.

In the coming years, that means huge things for our investors and the country. At an individual level, Kiwis are taking control of their financial futures, they are creating their own Lotto win and building their dream lives. Most of us don’t want a private jet, we just want financial security. Our investors are building it.

At a national level? We have a property crisis - an investment situation that’s built on a win/lose model. For me to get wealthy, someone else has to miss out on buying a home. With shares, we have a high quality, proven long-term wealth building strategy that delivers win/win returns. The US share markets have historically returned about 10% a year on average - which means you double your money every 7 years just by spreading it across the share markets (which you can do by investing in an Exchange-Traded Fund (ETF) like the Vanguard S&P 500).

You and I can both get those returns, and no one is negatively impacted by your success.

Clearly the internet has enabled Hatch to be brought into existence – how do you think about using the internet to reach prospective users, engage with existing customers, and as the internet evolves from here, how do you think that may end up being embraced with further innovation from Hatch?

Hatch is a digital business. We literally couldn’t exist or talk to our customers without it. Imagine trying to offer the level of support and service we do, for $3 USD an order to over 100,000 Kiwis over the phone. It’s impossible.

We run free monthly Wine and Wealth webinars to dispel investing myths and help Kiwis overcome the barriers to starting. We regularly get hundreds of people tuning in from the comfort of their own homes. Probably in their pajamas. Many of them would never turn up in person and many of them go on to become investing fanatics. So in one evening, the internet literally changed their entire future.

Hatch has gone from strength to strength as you’ve added additional investment opportunities, and the userbase has grown. What are some of Hatch’s most notable achievements to date, in your eyes?

Because of how we started, we’re not chasing revenue and making short term decisions to fund our growth. Our entire focus is on helping Kiwis build their dream lives over the long term, so every decision we make is a win/win for us and our customers.

We’ve dropped our pricing 3 times in 3 years as we’ve hit big milestones. Over 400 people have grown their wealth by more than $100,000, we get love notes every day from people who’ve completed our free 10 day Getting Started Course and have made their first investment. We hear stories of people selling their shares to pay off a mortgage, or selling their Tesla shares to buy a Tesla, or being able to give up work for 6 months to travel the country and spend time with their kids. Our customer base includes single mothers taking control of their own financial future, and recently retired couples becoming stock picking gurus.

I could ramble on about growing the team from 10 to 40 in 7 months, or adding Kids Accounts, or any of the stuff we’re working on right now. But those stories of Kiwis achieving their dreams are what gets us out of bed every morning and what drives the direction of Hatch.

The recent addition of “kids accounts” in Hatch has been a much-anticipated feature. Why was that feature added, and how should kiwi parents think about this?

It turns financial education on its head. Have you ever tried talking to your kids about money? It’s so boring. But it’s so important because time is an investor’s best friend. Did you know that if you invested $2,040 on the day your child was born, at that 10% average share market return, your investment would be worth $1 million by the time they’re 65. Without you having to lift a finger. So that’s cool, but say it to your teenager and their eyes will glaze over.

If instead you tell them they can own part of a company like Roblox, Nike, Apple or Lululemon, they see it as another way to express their creativity and individuality. They don’t think of it as financial education, it’s just this cool thing they can do that feels a bit grown up. Next minute, they’ll be having conversations with you about the benefit of selling their Nike shares for $100 profit, vs holding onto them and seeing how much more they could be worth. They’ll see all their friends join Tiktok and think ‘hmm this feels like a cool company, I should buy shares in it’. They’ll see how valuable it is to put money aside for the future. Without one single text book or lecture.

Of course, an adult controls the account for anyone under 18 and many Kiwi adults are also new to investing. How cool is it for parents to model a growth mindset for their kids and learn together?

You’re clearly very passionate about helping New Zealanders take control of their financial futures. Can you give us some insight into how you first started thinking about this, and how your thinking on the subject has evolved during your involvement with Hatch?

My first share market investment was way back when Xero listed on the NZX. I loved the company and got great delight in having the opportunity to be part of the success story. It’s cool to say ‘I own a slice of that’, and Xero has had a huge impact on my financial security. The 1,000 shares I bought for $1 each are now worth $123 each. It was way harder to invest then, but I spent years trying to convince people around me that it wasn’t a dark art and that you can start small and take your time, growing your portfolio as you felt more comfortable.

Fast forward about 14 years, and investing has helped change my life. I never thought I could wind up in this position, and no one tells you how straightforward it can be. I just keep adding to a very simple set of investments every pay day, and compounding growth has done the rest.

Before Hatch, the barriers were simply too high for most people. The fees and the finance industry were unwelcoming and scary. Investing felt like it was the domain of the rich and well-suited. Now, if you walk into a room of 100 people in NZ, at least 2 of them will be investing through Hatch, and our customer base is increasing by 16% month on month. What seemed like an idealistic dream, now seems achievable. New Zealand is a spectacular country, and the share markets are helping a lot of Kiwis live their best lives here.

You have been involved in (and co-founded) several start-ups already in your professional career I understand – what do you attribute this to? Can you point to any early influences that steered you in this entrepreneurial direction, or has it been largely down to how you view opportunities, or something else?

My dad was in the military, so we grew up travelling the world. As I got older, I realised seeing the way different people live, the opportunities we have here and how big the world is makes a huge difference in how you view life. So travel is still a huge part of my life - even now, I love exploring parts of New Zealand. We’re one country but each area really is quite different and you learn so much from that.

My mum is quite entrepreneurial, she couldn’t usually hold down a fulltime job because of all the moving and dad being away. But she found opportunities everywhere; from teaching at refugee camps, to creating art and even dog walking. My parents have never let life happen to them, and that philosophy rubbed off.

The other big factor is self-confidence. It’s vital to back yourself and is extremely hard to do that if you need a lot of external validation. It takes a lot of work to learn to be comfortable with who you are, and a lot of failure. Every time you make a mistake, or have to rely on yourself to get out of a pickle, you’re building resilience and self-belief. So don’t be scared of taking chances, you’ll learn how capable you really are.

What aspect of Hatch are you most excited about currently?

The challenge ahead. Every day is different and sometimes it can be a long time between wins. It’s really, really hard to grow a business, even if it’s doing well. It can be exhausting but that challenge drives all of us.

Are you able to share any insights into what users of Hatch can look forward to as additional features or investment types in the platform?

Yes! We build Hatch alongside our customers based on the problems they’re trying to solve. Our customer base is pretty unique; we have a similar number of people just starting out as we do people with millions invested with us. So expect more cool investment options; more markets and access to new types of investments. Also expect a more tailored experience that meets you where you’re at.

Many Kiwis, myself included, haven’t started on our investment journey until many years into our adult life – and in fact many never invest beyond what they “have to” via Kiwisaver. Obviously you can’t give financial advice here, but what would you urge people of all ages to think about when wondering if investing is for them, or whether getting started is worthwhile if you don’t have large sums of money to invest?

Build a buffer first. You never want to be in a position where you need to sell your shares in a hurry. Make sure you have enough savings to cover short term emergencies.

But don’t wait until you have a lot of money before you start. A lot of Lotto winners go bankrupt, because they didn’t learn how to manage money before they got money.

Time is your best friend (look up compounding growth!).

Starting small doesn’t mean staying small. The amount doesn’t matter as much as the habit, and once you’re in the habit, grow the amount.

Start with $100 and think of it as education money. A lot of people are scared to lose money from investing, but they’re happy to spend $100 on education, so remove that mental barrier for yourself. The rest will flow on naturally from there.

Investing is a long term game. It’s not gambling. Building wealth takes a while and generally the lazier you are and the more you leave your investments alone, the better you do (KiwiSaver should have taught us all this!).

The biggest risk when it comes to investing is doing nothing. Yes, you may make some mistakes, but the biggest mistake is working for every cent you ever earn in your life.

Tesla (TSLA) have been a runaway success lately, as they’ve continued to prove their execution ability and increased what some would say is an unassailable lead when it comes to battery technology and autonomous vehicle AI training data and so on. What are your own thoughts on this, and are there any other companies/funds that have caught your attention recently?

I’m Elon’s biggest fan, I think he’s a once-in-a-generation mind and Tesla is a company like we’ve never seen before. It can’t be categorised! Is it a vehicle company? A battery company? An artificial intelligence company? What they are doing is unbelievable and I think most of us can’t even begin to understand their vision. But it’s a long term investment. Tesla won’t change the world by the end of 2021. I don’t care if they hit short term revenue targets, I don’t even look at their day to day share price. I’ll keep my shares for at least 20 years.

I love Cathie Wood too. She started a fund management company called ARK (you can invest in their funds through Hatch). She only invests in disruptive companies and she hires industry experts instead of finance people. She’s completely open about her philosophy and she has complete conviction in her beliefs. Google her, she’s a powerhouse.

But while I’m well known for my passionate rants about the next big thing, my investments are actually largely boring. I like buying shares in funds because they spread your money across a lot of investments at once. I put a fair chunk of my money in the Vanguard S&P 500 fund which spreads it across the 500 biggest companies listed on the US share markets. As my wonderful friend told me once ‘none of the companies listed on the US share markets want to fail’, and certainly the largest 500 have a pretty good track record of success! However, even if 10 of them struggle, the impact on my money is minimal, so I can sleep soundly at night.

What upcoming company/fund additions to Hatch are on the horizon that people should be aware of?

We generally get newly listed companies as soon as they hit the market. Unlike the NZX, there are hundreds of new listings in the US every year, recent additions include Airbnb, Slack and Roblox. We’re expecting RocketLabs, a New Zealand founded company to list this year and ARK is working on a bunch of cool new funds, including one that only invests in space companies. But the cool thing about investing is everyone has their own interests and the world is a big place. There are probably companies that you care about that will be listed soon, and I don’t even know those companies exist.

Are you able to share any insights into the growth of your userbase or other interesting metrics? It appears to be growing quickly, reflecting the trend of retail investing continuing to flourish around the world.

We have over 100,000 Kiwis in our community and that number is growing by about 16% month on month. Kiwis have invested well over half a billion dollars through Hatch.

About 20% of our customers are referred to Hatch from a happy investor - Kiwis love to give each other a legup.

What are your thoughts on the rise of passive ETF (Exchange Traded Fund) investing, such as the S&P 500, versus actively managed funds - or picking stocks of specific companies which you understand and believe in for example?

Both have a role. We love the concept of ‘core and conviction’ - where 60-80% of your money sits in low cost, ‘boring’ Exchange-Traded Funds (ETFs) and the rest is in things you care about. You substantially lower the risks of making a bad decision because your money is spread across a lot of investments, but you get the excitement and interest that comes with truly backing what you believe. It really is that simple.

You and Kristen Lunman appear to have a great rapport, and your “Wine and Wealth Wednesday” chats on YouTube for instance feel very authentic and natural. How do you think about this, and the wider culture and communication of Hatch as a whole?

One of the biggest myths with investing is that it’s about money. It’s actually about the thing money can buy: control over your life. Investing absolutely becomes a hobby, it’s really fun! But what Hatch is all about is helping dispel these awful myths about investing and give Kiwis the opportunity to see what it really is. If we can do that, and can combine it with a straightforward investing experience, our customers can do the rest themselves.

You have had a focus on UX (User Experience) at Hatch, and at prior companies I believe. I’d love to hear more about how you think about that process, both from a clean slate perspective, and also for existing companies trying to improve their user experience while continuing to operate their business.

Hatch isn’t a finance company, it’s an experience company. Why? Because investing is 99% about emotions - fear of starting, fear of mistakes, anxiety about share price increases and decreases, fighting the desire to make a quick win. Our experience was designed from the ground up to remove the barriers to starting, debunk the myths and make it easy to make smart decisions. We’re not about gambling, or dabbling with a few bucks, or trading your money away. We’re about long-term wealth building and that means every interaction you have with Hatch, from the way our customers talk about us, to our Facebook community, to our support team, free Getting Started Course and app is focused on giving Kiwis the best chance of success.

Recently we saw unprecedented worldwide activity around GameStop stock stemming from Reddit community /r/WallStreetBets, resulting in huge stock volatility, and at least one multi-billion dollar Hedge Fund getting steamrolled by a tsunami of retail investor interest. As the war cry of “We like the stock” went viral, some people made life-changing fortunes, and many others got burnt by jumping on the meme-bandwagon too late. How do you view what happened, and what is Hatch’s position on the selling of order-flow data and the limiting of stock buy/sell activity?

Here’s the thing about GameStop: it wouldn’t have been possible 5 years ago. Before Hatch, Kiwis couldn’t even buy shares in GameStop without paying hundreds of dollars in fees. Now, everyday investors not just expect to be able to buy shares, they have displayed their combined power and how they can impact the global share markets. That’s brilliant! In New Zealand, we kickstarted this revolution.

But this is a big old clunky industry, it’s been around for a century and we just can’t expect immediate change. Even if everyone within the industry was doing their utmost, it takes a lot of work to take systems that are fit-for-purpose for a few big players and adapt them to work for literally millions of smaller ones. Just like the taxi industry and the hotel industry and every other industry disrupted by technology, there will be bumps in the road, but events like GameStop are proof that we’re getting there.

What are you most proud of in terms of what Hatch offers its users?

How we give them the ability to build their dream lives.

Thank you again for taking the time to talk Natalie! As a relatively recent Hatch user myself I’ve really been looking forward to digging into these topics with you. Is there anything else you’d like to mention which we haven’t already covered?

We have an incredible support team. Their one job is to help you get started with Hatch and help you be successful - no matter whether you’re an experienced investor or complete newbie. If you have a large share portfolio already that you’d like to bring to Hatch, or you’ve never thought investing was for you, or you have any questions at all, please get in touch. Just flick us an email, use the live chat on our website, or you can even tell us a good time to call you. It’s free to talk to us and we have a wealth of information to help you take the next step.

For anyone interested in learning more about Hatch, where should they start?

Head to www.hatchinvest.nz, or you can learn about investing through our free 10 day Getting Started Course - complete it online in just 10 minutes a day.

Interested in more interviews with innovative Kiwis?

Well good news, we have a bunch more on the way, continuing our Kiwi Innovation Spotlight series!

Thanks again to Natalie for sharing her thoughts with us today, plenty to think about here.

Winners - Best Business Broadband Provider & People's Choice - Broadband 2025

Winners - Best Business Broadband Provider & People's Choice - Broadband 2025